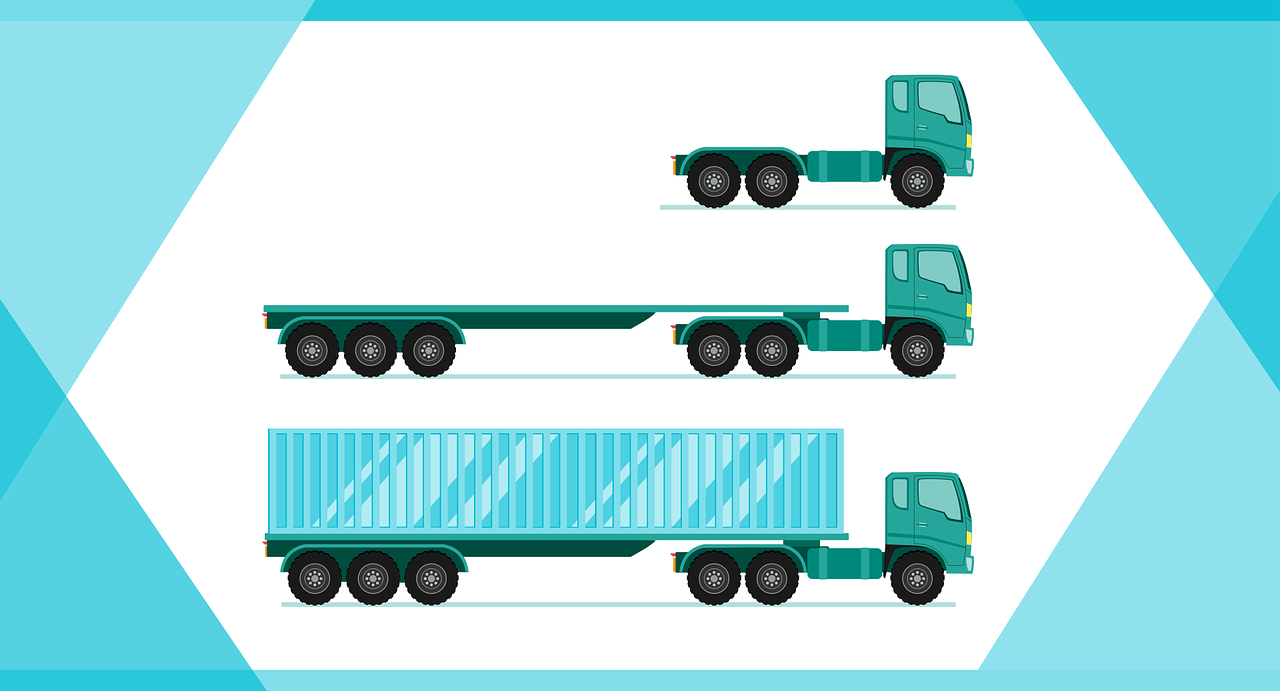

Non-Owned Trailer Protection for your Business?

Non-Owned Trailer Protection – One unique coverage that you will find

on for-hire truck insurance policies involves the protection for nonowner trailers.

This coverage is while in the insured’s possession, or for the insured’s trailer while

in the possession of someone other than the insured itself. This coverage is also known

in the insurance language as trailer interchange insurance.

Coverage Exchange?

This coverage addresses the exposures that are created by the exchanging of trailers.

This exchange is between trucking risk under various interchange agreements.

Typically, you will see these agreements for users of non-owned trailers,

that are legally liable for physical damage

to such trailers. Insurance companies will usually provide this coverage by

incorporating it into their trucker’s policies.

Non-Owned Trailer Protection –

(Form Coverage Stance)

It is important to keep this information in mind. This is

because trailer interchange insurance is based upon a trucker’s legal liability.

Most forms of this coverage are issued as third-party liability protection.

This is predicated upon the existence of a written interchange agreement

Nonetheless, some companies will write interchange coverage as a first party physical

damage coverage. They can do this by adding a specified

amount for an undescribed, non-owner trailer

to the vehicle schedule.

Non-Owned Trailer Protection – Additional Insurance Coverage?

This will then provide primary physical damage coverage on any non-owned trailers.

This is without any requirement that a written agreement should be in place.

It is also important to note, that this approached is

used when an insurance agent reviews

the physical damage policy portion for a possible subrogation clause.

It also involves the elimination to comply with any contractual requirements.

Trucking Insurance Risks

Another area of concern that will be reviewed is, the trucking risks

involved in the relationship between larger trucking companies.

This relationship between the larger and the smaller trucking companies

may lease vehicles, from owner or operators as an example. This situation is not uncommon.

This is because the shipper demands the trucking services can be often unpredictable.

This means it is difficult for transit companies to maintain

an adequate number of vehicles, at any given time.

Supply and Demand for your Business Operation

To meet shippers’ needs, trucking companies will often enter into vehicle lease agreements.

They will enter these agreements with other truckers. There are provisions that

will be contained in these agreements. They will specify who will be liable for loss

s or damage that has resulted from the operation of such leased vehicles.

This is typically done when the lessee is leasing the vehicle on a long-term basis.

The lessee will retain responsibility for damages and will schedule the lessor’s vehicle

onto their trucker’s policy.

Individualized Insurance Policy

On a specified trucker’s policy, the premium would be collected based on the hired auto rate.

This is to include how many drivers are listed on the policy section.

So, therefore, it depends on a for hire basis or not.

From a reporting form perspective, the premium would be assessed by including

the mileage of the leased vehicle in the monthly report of miles traveled.

You should note, that under ISO’s format, if the leased, hired, rented or

borrowed auto includes a driver, an additional endorsement page, must

be attached. This is to provide primary physical damage coverage for such autos.

Trip Lease Coverage Trip – Non-Owned Trailer Protection

leases pose a different set of problems. This is because they too, can involve arrangements

whereby the lessee will retain responsibility. This responsibility is for the leased vehicles,

but it can also include the inverse situation In this type of scenario, the lessor agrees to

indemnify the lessee for damage. This is because of a result from operation of their

leased vehicle. This must carry be carried on their own policy with the lessee

addended, as an additional insured.

Questions & Answers for your Operation

Common questions and answers to the trucking industry

Let’s look at the policy definitions and conditions that surround a policy.

This is important, since most of these answers are also answers to some common

questions regarding this industry. So, you solve 2 issues with one example.

Common Policy Talk for your Trucking and Business Operation

For the most part, all insurance policies will contain common definitions and

conditions that are specifically catered to the mechanics of that policy. It will

include not just the definitions but also how they are administered. Many of

these policy provisions will apply to one or more policies at a time.

Case Example

For example, ISO’s Common Policy Conditions form is a mandatory attachment for several

of the lines of the coverage included in their package policies. We will show a

list of the common manuscript definitions and conditions endorsements that

have been developed over the years to broaden coverage. This is seen in a variety of

insurance policies. You will want to keep in mind, that a number of these are already

included in many policies without the need for separate manuscript wording.

What is Broadened Named Insured Endorsement?

This endorsement form is used to extend a policy to provide automatic coverage.

This coverage is for any organizations that a trucker should own, create, or will

acquire during the policy year. Currently, the only ISO policy that provides any

automatic coverage for maned insures is the commercial general liability form.

Concluding Thoughts on Trucking Business and Operation

As you have examined in this article, Non-Owned Trailer Protection

is for a specific coverage for your trucking business.

This should be reviewed with an insurance professional to ensure

that you are maximizing your business protection.

Protection for your operation should be reviewed in its entirety

to ensure that no gaps in protection are left unattended.

Commercial Insurance Agency Review

There are many details to your insurance policy, especially one for your trucking

or business policy. This commercial general policy should

always be reviewed annually or at the time of renewal.

This is because like with most things in life, business operations can change.

For example, the hiring of new employees, or purchase of new vehicles for your operation.

These changes should always be reported to your insurance company and

insurance representative at the time, regardless of the policy term.

This is in addition to a yearly policy review.